Traditional PC Market Delivers Another Quarter of Double-Digit Growth in Q3 2020, According to IDC

FRAMINGHAM, Mass., Octo┬Łber 12, 2020 ŌĆō As the glo┬Łbal pan┬Łde┬Łmic rages on and many count┬Łries around the world enter the second wave of COVID-19 infec┬Łtions, con┬Łti┬Łnui┬Łty of busi┬Łness and online schoo┬Łling remain at the fore┬Łfront of every eco┬Łno┬Łmy. This led to dou┬Łble-digit growth in the tra┬Łdi┬Łtio┬Łnal PC mar┬Łket, com┬Łpri┬Łsed of desk┬Łtops, note┬Łbooks, and work┬Łsta┬Łtions, as glo┬Łbal ship┬Łments grew 14.6% year over year to 81.3 mil┬Łli┬Łon units in the third quar┬Łter of 2020 (3Q20), accor┬Łding to preli┬Łmi┬Łna┬Łry results from the Inter┬Łna┬Łtio┬Łnal Data Cor┬Łpo┬Łra┬Łti┬Łon (IDC) World┬Łwi┬Łde Quar┬Łter┬Łly Per┬Łso┬Łnal Com┬Łpu┬Łting Device Tra┬Łcker.

ŌĆ£Con┬Łsu┬Łmer demand and insti┬Łtu┬Łtio┬Łnal demand approa┬Łched record levels in some cases,ŌĆØ said Jitesh Ubra┬Łni rese┬Łarch mana┬Łger for IDCŌĆÖs Mobi┬Łle Device Tra┬Łckers. ŌĆ£Gam┬Łing, Chrome┬Łbooks, and in some cases cel┬Łlu┬Łlar-enab┬Łled note┬Łbooks were all bright spots during the quar┬Łter. Had the mar┬Łket not been ham┬Łpe┬Łred by com┬Łpo┬Łnent shorta┬Łges, note┬Łbook ship┬Łments would have soared even hig┬Łher during the third quar┬Łter as mar┬Łket appe┬Łti┬Łte was yet unsatiated.ŌĆØ

Unfort┬Łu┬Łna┬Łte┬Łly, shorta┬Łges of mul┬Łti┬Łple com┬Łpon┬Łents, such as pro┬Łces┬Łsors, panels, and other sub┬Łcom┬Łpon┬Łents, led to missed oppor┬Łtu┬Łni┬Łty for many ven┬Łdors. ŌĆ£The PC indus┬Łtry rode into the third quar┬Łter with a sizeable back┬Łlog of unful┬Łfil┬Łled orders,ŌĆØ said Linn Huang, rese┬Łarch vice pre┬Łsi┬Łdent, Devices and Dis┬Łplays at IDC. ŌĆ£And it appears the quar┬Łter will end under the same auspi┬Łces. Given that the shorta┬Łges have been due more to a short┬Łfall of busi┬Łness plan┬Łning than a tech┬Łni┬Łcal glitch, we do not anti┬Łci┬Łpa┬Łte a sud┬Łden sur┬Łge in capa┬Łci┬Łty. Con┬Łse┬Łquent┬Łly, this back┬Łlog will likely car┬Łry into 2021.ŌĆØ

Regio┬Łnal Highlights

Asia/Pacific (exclu┬Łding Japan) (APeJ): The Tra┬Łdi┬Łtio┬Łnal PC mar┬Łket pos┬Łted a sin┬Łgle digit increase in the regi┬Łon with results coming in abo┬Łve IDCŌĆÖs fore┬Łcast. Ship┬Łments were dri┬Łven by inven┬Łto┬Łry rep┬Łle┬Łnish┬Łments and strong demand for note┬Łbooks as end users across the regi┬Łon con┬Łtin┬Łued to purcha┬Łse devices for work from home, online lear┬Łning, and enter┬Łtain┬Łment purposes.

Cana┬Łda: The Tra┬Łdi┬Łtio┬Łnal PC mar┬Łket remain┬Łed extre┬Łme┬Łly acti┬Łve, pos┬Łting the 17th con┬Łse┬Łcu┬Łti┬Łve quar┬Łter of gains. This is the second quar┬Łter whe┬Łre COVID-19-rela┬Łted rest┬Łric┬Łtions were in effect, con┬Łti┬Łnuing to boost demand from Cana┬Łdi┬Łan house┬Łholds and from orga┬Łniza┬Łti┬Łons loo┬Łking to ensu┬Łre busi┬Łness con┬Łti┬Łnui┬Łty through stay-at-home situa┬Łtions. The need for com┬Łpu┬Łting devices in Cana┬Łda should remain high throug┬Łhout the win┬Łter but spen┬Łding might be impac┬Łted by the macro-eco┬Łno┬Łmic situa┬Łti┬Łon, incre┬Łasing pres┬Łsu┬Łre on avera┬Łge sel┬Łling pri┬Łces for the fore┬Łseeable future.

Euro┬Łpe, Midd┬Łle East, and Afri┬Łca (EMEA): Tra┬Łdi┬Łtio┬Łnal PC ship┬Łments achie┬Łved high sin┬Łgle-digit growth in 3Q20 as ano┬Łther excep┬Łtio┬Łnal quar┬Łter of growth for note┬Łbook out┬Łweig┬Łhed hea┬Łvy desk┬Łtop decli┬Łnes. The ongo┬Łing lock┬Łdowns con┬Łtin┬Łued to dri┬Łve high demand for note┬Łbooks to enable enter┬Łtain┬Łment, working, and stu┬Łdy┬Łing from home. Howe┬Łver, with offices lar┬Łge┬Łly remai┬Łning clo┬Łsed the┬Łre was limi┬Łt┬Łed demand for sta┬Łtio┬Łna┬Łry devices.

Japan: The GIGA pro┬Łject through which stu┬Łdents all over the coun┬Łtry recei┬Łve PCs and tablets for online lear┬Łning, as well as strong work-from-home demand hel┬Łped main┬Łtain flat growth in the tra┬Łdi┬Łtio┬Łnal PC mar┬Łket. The con┬Łsu┬Łmer seg┬Łment decli┬Łned year over year due to the high base┬Łline set last year by the con┬Łsump┬Łti┬Łon tax hike and Win┬Łdows 10 migrations.

Latin Ame┬Łri┬Łca: The tra┬Łdi┬Łtio┬Łnal PC mar┬Łket pos┬Łted dou┬Łble-digit growth for first time in five years. Despi┬Łte pri┬Łce increa┬Łses and eco┬Łno┬Łmic con┬Łtrac┬Łtions in many count┬Łries, the demand for por┬Łta┬Łbi┬Łli┬Łty con┬Łti┬Łnues to rise. Hig┬Łher note┬Łbook demand due to work-from-home and online lear┬Łning sus┬Łtained the regionŌĆÖs growth, which is expec┬Łted to con┬Łti┬Łnue in most count┬Łries into ear┬Łly 2021.

USA: The tra┬Łdi┬Łtio┬Łnal PC mar┬Łket wit┬Łnessed yet ano┬Łther extra┬Łor┬Łdi┬Łna┬Łry quar┬Łter pos┬Łting strong dou┬Łble-digit ship┬Łment growth. Preli┬Łmi┬Łna┬Łry results reflect con┬Łtin┬Łued strong buy┬Łer sen┬Łti┬Łment fue┬Łled by stay-at-home PC needs and resul┬Łtant inven┬Łto┬Łry rep┬Łle┬Łnish┬Łment. While note┬Łbook ship┬Łments streng┬Łthe┬Łned fur┬Łther due to sus┬Łtained demand from the con┬Łsu┬Łmer and edu┬Łca┬Łti┬Łon seg┬Łments, the desk┬Łtop mar┬Łket decli┬Łned year over year but found some respi┬Łte as gam┬Łing sys┬Łtems remain┬Łed in demand.

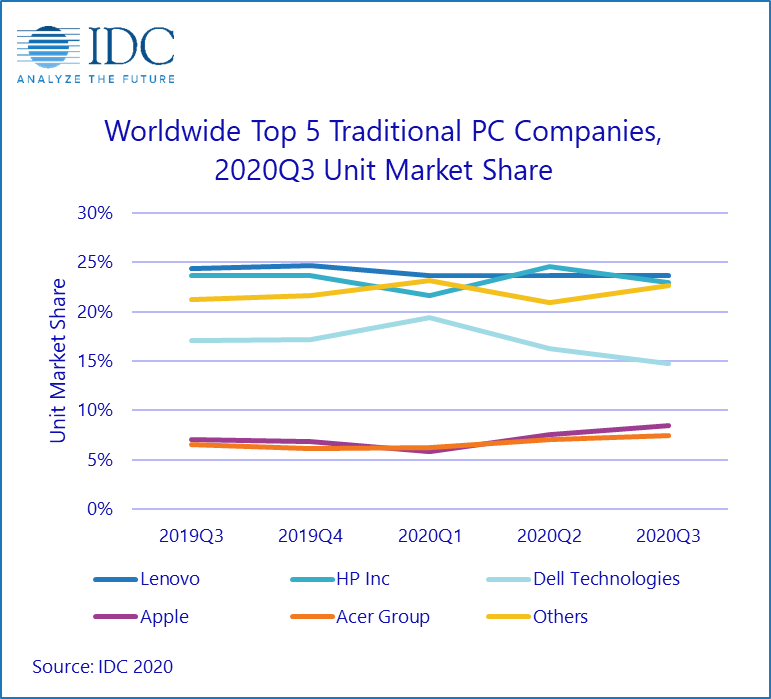

| Top 5 Com┬Łpa┬Łnies, World┬Łwi┬Łde Tra┬Łdi┬Łtio┬Łnal PC Ship┬Łments, Mar┬Łket Share, and Year-Over-Year Growth, Q3 2020 (Preli┬Łmi┬Łna┬Łry results, ship┬Łments are in thou┬Łsands of units) | |||||

| Com┬Łpa┬Łny | 3Q20 Ship┬Łments | 3Q20 Mar┬Łket Share | 3Q19 Ship┬Łments | 3Q19 Mar┬Łket Share | 3Q20/3Q19 Growth |

| 1. Leno┬Łvo | 19,272 | 23.7% | 17,310 | 24.4% | 11.3% |

| 2. HP Inc. | 18,690 | 23.0% | 16,805 | 23.7% | 11.2% |

| 3. Dell Technologies | 11,996 | 14.8% | 12,098 | 17.1% | -0.8% |

| 4. Apple | 6,890 | 8.5% | 4,959 | 7.0% | 38.9% |

| 5. Acer Group | 6,005 | 7.4% | 4,644 | 6.6% | 29.3% |

| Others | 18,419 | 22.7% | 15,091 | 21.3% | 22.1% |

| Total | 81,272 | 100.0% | 70,907 | 100.0% | 14.6% |

| Source: IDC Quar┬Łter┬Łly Per┬Łso┬Łnal Com┬Łpu┬Łting Device Tra┬Łcker, Octo┬Łber 12, 2020 | |||||

Notes:

- Some IDC esti┬Łma┬Łtes pri┬Łor to finan┬Łcial ear┬Łnings reports. Data for all com┬Łpa┬Łnies are repor┬Łted for calen┬Łdar periods.

- Ship┬Łments include ship┬Łments to dis┬Łtri┬Łbu┬Łti┬Łon chan┬Łnels or end users. OEM sales are coun┬Łted under the company/brand under which they are sold.

- Tra┬Łdi┬Łtio┬Łnal PCs include Desk┬Łtops, Note┬Łbooks, and Work┬Łsta┬Łtions and do not include Tablets or x86 Ser┬Łvers. Detacha┬Łble Tablets and Sla┬Łte Tablets are part of the Per┬Łso┬Łnal Com┬Łpu┬Łting Device Tra┬Łcker but are not addres┬Łsed in this press release.

IDCŌĆÖs World┬Łwi┬Łde Quar┬Łter┬Łly Per┬Łso┬Łnal Com┬Łpu┬Łting Device Tra┬Łcker gathers detail┬Łed mar┬Łket data in over 90 count┬Łries. The rese┬Łarch includes his┬Łto┬Łri┬Łcal and fore┬Łcast trend ana┬Łly┬Łsis among other data.

For more infor┬Łma┬Łti┬Łon, or to sub┬Łscri┬Łbe to the rese┬Łarch, plea┬Łse cont┬Łact Kathy Nagam┬Łi┬Łne at 650ŌĆō350-6423 or knagamine@idc.com.

About IDC Trackers

IDC Tra┬Łcker pro┬Łducts pro┬Łvi┬Łde accu┬Łra┬Łte and time┬Łly mar┬Łket size, com┬Łpa┬Łny share, and fore┬Łcasts for hundreds of tech┬Łno┬Łlo┬Łgy mar┬Łkets from more than 100 count┬Łries around the glo┬Łbe. Using pro┬Łprie┬Łta┬Łry tools and rese┬Łarch pro┬Łces┬Łses, IDCŌĆÖs Tra┬Łckers are updated on a semi┬Łan┬Łnu┬Łal, quar┬Łter┬Łly, and month┬Łly basis. Tra┬Łcker results are deli┬Łver┬Łed to cli┬Łents in user-fri┬Łend┬Łly Excel deli┬Łver┬Ła┬Łbles and on-line query tools.

Click here to learn about IDCŌĆÖs full suite of data pro┬Łducts and how you can levera┬Łge them to grow your business.

About IDC

Inter┬Łna┬Łtio┬Łnal Data Cor┬Łpo┬Łra┬Łti┬Łon (IDC) is the pre┬Łmier glo┬Łbal pro┬Łvi┬Łder of mar┬Łket intel┬Łli┬Łgence, advi┬Łso┬Łry ser┬Łvices, and events for the infor┬Łma┬Łti┬Łon tech┬Łno┬Łlo┬Łgy, tele┬Łcom┬Łmu┬Łni┬Łca┬Łti┬Łons, and con┬Łsu┬Łmer tech┬Łno┬Łlo┬Łgy mar┬Łkets. With more than 1,100 ana┬Łlysts world┬Łwi┬Łde, IDC offers glo┬Łbal, regio┬Łnal, and local exper┬Łti┬Łse on tech┬Łno┬Łlo┬Łgy and indus┬Łtry oppor┬Łtu┬Łni┬Łties and trends in over 110 count┬Łries. IDCŌĆÖs ana┬Łly┬Łsis and insight helps IT pro┬Łfes┬Łsio┬Łnals, busi┬Łness exe┬Łcu┬Łti┬Łves, and the invest┬Łment com┬Łmu┬Łni┬Łty to make fact-based tech┬Łno┬Łlo┬Łgy decis┬Łi┬Łons and to achie┬Łve their key busi┬Łness objec┬Łti┬Łves. Foun┬Łded in 1964, IDC is a whol┬Łly-owned sub┬Łsi┬Łdia┬Łry of Inter┬Łna┬Łtio┬Łnal Data Group (IDG), the worldŌĆÖs lea┬Łding tech media, data and mar┬Łke┬Łting ser┬Łvices com┬Łpa┬Łny. To learn more about IDC, plea┬Łse visit www.idc.com. Fol┬Łlow IDC on Twit┬Łter at @IDC and Lin┬Łke┬ŁdIn. Sub┬Łscri┬Łbe to the IDC Blog for indus┬Łtry news and insights: http://bit.ly/IDCBlog_Subscribe.

All pro┬Łduct and com┬Łpa┬Łny names may be trade┬Łmarks or regis┬Łtered trade┬Łmarks of their respec┬Łti┬Łve holders.