TSMC Reports Second Quarter EPS of NT$7.01

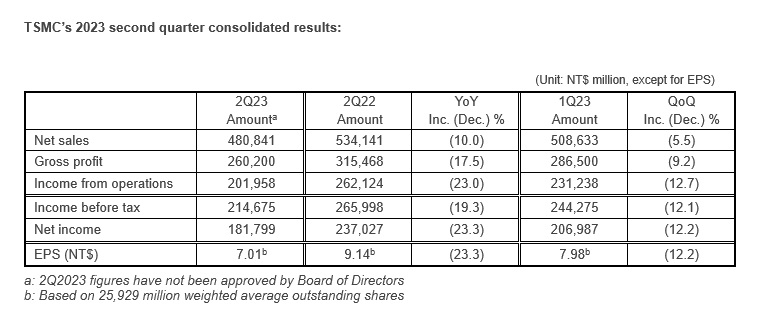

HSINCHU, Tai┬Łwan, R.O.C., Jul. 20, 2023 ŌĆö TSMC (TWSE: 2330, NYSE: TSM) today announ┬Łced con┬Łso┬Łli┬Łda┬Łted reve┬Łnue of NT$480.84 bil┬Łli┬Łon, net inco┬Łme of NT$181.80 bil┬Łli┬Łon, and diluted ear┬Łnings per share of NT$7.01 (US$1.14 per ADR unit) for the second quar┬Łter ended June 30, 2023.

Year-over-year, second quar┬Łter reve┬Łnue decreased 10.0% while net inco┬Łme and diluted EPS both decreased 23.3%. Com┬Łpared to first quar┬Łter 2023, second quar┬Łter results repre┬Łsen┬Łted a 5.5% decrease in reve┬Łnue and a 12.2% decrease in net inco┬Łme. All figu┬Łres were pre┬Łpared in accordance with TIFRS on a con┬Łso┬Łli┬Łda┬Łted basis.

In US dol┬Łlars, second quar┬Łter reve┬Łnue was $15.68 bil┬Łli┬Łon, which decreased 13.7% year-over-year and decreased 6.2% from the pre┬Łvious quarter.

Gross mar┬Łgin for the quar┬Łter was 54.1%, ope┬Łra┬Łting mar┬Łgin was 42.0%, and net pro┬Łfit mar┬Łgin was 37.8%.

In the second quar┬Łter, ship┬Łments of 5ŌĆænanometer accoun┬Łted for 30% of total wafer reve┬Łnue; 7- nano┬Łme┬Łter accoun┬Łted for 23%. Advan┬Łced tech┬Łno┬Łlo┬Łgies, defi┬Łned as 7ŌĆænanometer and more advan┬Łced tech┬Łno┬Łlo┬Łgies, accoun┬Łted for 53% of total wafer revenue.

ŌĆ£Our second quar┬Łter busi┬Łness was impac┬Łted by the over┬Łall glo┬Łbal eco┬Łno┬Łmic con┬Łdi┬Łti┬Łons, which dam┬Łpened the end mar┬Łket demand, and led to cus┬Łto┬ŁmersŌĆÖ ongo┬Łing inven┬Łto┬Łry adjus┬Łt┬Łment,ŌĆØ said Wen┬Łdell Huang, VP and Chief Finan┬Łcial Offi┬Łcer of TSMC. ŌĆ£Moving into third quar┬Łter 2023, we expect our busi┬Łness to be sup┬Łport┬Łed by the strong ramp of our 3ŌĆænanomenter tech┬Łno┬Łlo┬Łgies, par┬Łti┬Łal┬Łly off┬Łset by cus┬Łto┬ŁmersŌĆÖ con┬Łtin┬Łued inven┬Łto┬Łry adjustment.ŌĆØ

Based on the CompanyŌĆÖs cur┬Łrent busi┬Łness out┬Łlook, manage┬Łment expects the over┬Łall per┬Łfor┬Łmance for third quar┬Łter 2023 to be as follows:

- Reve┬Łnue is expec┬Łted to be bet┬Łween US$16.7 bil┬Łli┬Łon and US$17.5 billion;

And, based on the exch┬Łan┬Łge rate assump┬Łti┬Łon of 1 US dol┬Łlar to 30.8 NT dollars,

- Gross pro┬Łfit mar┬Łgin is expec┬Łted to be bet┬Łween 51.5% and 53.5%;

- Ope┬Łra┬Łting pro┬Łfit mar┬Łgin is expec┬Łted to be bet┬Łween 38% and 40%.