Kategorie: News

GlobalFoundries Reports Fourth Quarter and Fiscal Year 2021 Financial Results

Record Reve┬Łnue, Gross, and Ope┬Łra┬Łting Margins

MALTA, N.Y., Feb. 08, 2022 (GLOBE NEWSWIRE) ŌĆö Glo┬Łbal┬ŁFound┬Łries Inc. (GF) (Nasdaq: GFS) today announ┬Łced preli┬Łmi┬Łna┬Łry finan┬Łcial results for the fourth quar┬Łter and fis┬Łcal year ended Decem┬Łber 31, 2021.

Key Fourth Quar┬Łter Finan┬Łcial Highlights

- Record reve┬Łnue of $1.85 bil┬Łli┬Łon, up 9% sequentially.

- Record gross mar┬Łgin of 20.8% and adjus┬Łted gross mar┬Łgin of 21.5%.

- Record ope┬Łra┬Łting mar┬Łgin of 5% and adjus┬Łted ope┬Łra┬Łting mar┬Łgin of 8%.

- Net inco┬Łme mar┬Łgin of 2% and adjus┬Łted EBITDA mar┬Łgin of 32%.

- Cash and cash equi┬Łva┬Łlents of $2.9 billion.

Key Full Year 2021 Finan┬Łcial Highlights

- Reve┬Łnue of $6.6 bil┬Łli┬Łon, up 36% year-over-year.

- Record gross mar┬Łgin of 15% and adjus┬Łted gross mar┬Łgin of 16%.

- Net inco┬Łme mar┬Łgin of ŌĆæ4% and adjus┬Łted EBITDA mar┬Łgin of 28%.

ŌĆ£2021 was an out┬Łstan┬Łding year for GF, during which we dro┬Łve an acce┬Łle┬Łra┬Łti┬Łon of our busi┬Łness plan by capi┬Łta┬Łli┬Łzing on the demand for per┬Łva┬Łsi┬Łve semi┬Łcon┬Łduc┬Łtor solu┬Łti┬Łons and the vital role we play in the semi┬Łcon┬Łduc┬Łtor sup┬Łp┬Łly chain,ŌĆØ said Tom Caul┬Łfield, CEO of GF. ŌĆ£Our reve┬Łnue grew 36% year-over-year, and we made signi┬Łfi┬Łcant pro┬Łgress towards our long-term finan┬Łcial pro┬Łfit model. The year was also mark┬Łed by a gro┬Łwing num┬Łber of long-term part┬Łner┬Łship agree┬Łments, with 30 cus┬Łto┬Łmers com┬Łmit┬Łting more than $3.2 bil┬Łli┬Łon toward the con┬Łtin┬Łued expan┬Łsi┬Łon of our glo┬Łbal manu┬Łfac┬Łtu┬Łring foot┬Łprint to sup┬Łport strong demand. We are exe┬Łcu┬Łting well, and belie┬Łve we are on track to deli┬Łver ano┬Łther year of strong growth in reve┬Łnue and pro┬Łfi┬Łta┬Łbi┬Łli┬Łty in 2022.ŌĆØ

Major 2021 Accom┬Łplish┬Łments and Key Fourth Quar┬Łter Busi┬Łness Highlights:

(ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

NVIDIA and SoftBank Group Announce Termination of NVIDIAŌĆÖs Acquisition of Arm Limited

Soft┬ŁBank to Explo┬Łre Arm Public Offering

SANTA CLARA, Calif., and TOKYO ŌĆō Feb. 7, 2022 ŌĆō NVIDIA and Soft┬ŁBank Group Corp. (ŌĆ£SBGŌĆØ or ŌĆ£Soft┬ŁBankŌĆØ) today announ┬Łced the ter┬Łmi┬Łna┬Łti┬Łon of the pre┬Łvious┬Łly announ┬Łced tran┬Łsac┬Łtion wher┬Łeby NVIDIA would acqui┬Łre Arm Limi┬Łt┬Łed (ŌĆ£ArmŌĆØ) from SBG. The par┬Łties agreed to ter┬Łmi┬Łna┬Łte the Agree┬Łment becau┬Łse of signi┬Łfi┬Łcant regu┬Łla┬Łto┬Łry chal┬Łlenges pre┬Łven┬Łting the con┬Łsum┬Łma┬Łti┬Łon of the tran┬Łsac┬Łtion, despi┬Łte good faith efforts by the par┬Łties. Arm will now start pre┬Łpa┬Łra┬Łti┬Łons for a public offe┬Łring. (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

Mitarbeiterzahl bei AMD steigt auf 15.500 ŌĆö ├╝ber 2.500 Stellen unbesetzt

Laut aktu┬Łel┬Łlem SEC-Fil┬Łing hat AMD Ende 2021 etwa 15.500 Mit┬Łar┬Łbei┬Łter besch├żf┬Łtigt. Damit stieg die Mit┬Łar┬Łbei┬Łter┬Łan┬Łzahl inner┬Łhalb eines Jah┬Łres im Ver┬Łgleich zu Ende 2020 um 2.900 Per┬Łso┬Łnen oder fast 25 Pro┬Łzent. Aktu┬Łell schreibt AMD welt┬Łweit aber zus├żtz┬Łlich noch 2.535 offe┬Łne Stel┬Łlen aus. (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

AMD Radeon Software Adrenalin 22.2.1

Die neu┬Łes┬Łte Ver┬Łsi┬Łon der Rade┬Łon Soft┬Łware Adre┬Łna┬Łlin ŌĆö also des Trei┬Łbers f├╝r AMD-Gra┬Łfik┬Łkar┬Łten ŌĆö ist f├╝r Win┬Łdows 10 und Win┬Łdows 11 erschie┬Łnen. Die Ver┬Łsi┬Łon 22.2.1 unter┬Łst├╝tzt die Spie┬Łle ŌĆ£Dying Light 2ŌĆØ und ŌĆ£Lost ArkŌĆØ sowie die Com┬Łpu┬Łter┬Łgra┬Łfik-API Vul┬Łkan in der Ver┬Łsi┬Łon 1.3.

Zus├żtz┬Łlich wur┬Łde noch ein Feh┬Łler bei Rade┬Łon RX 6700 XT Kar┬Łten im Spiel ŌĆ£Fort┬Łni┬ŁteŌĆØ besei┬Łtigt. (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

LibreOffice 7.3.0 (Community)

Libre┬ŁOf┬Łfice ist ein kos┬Łten┬Łlo┬Łses, leis┬Łtungs┬Łstar┬Łkes Office-Paket, und ein Nach┬Łfol┬Łger von OpenOffice(.org). Sei┬Łne kla┬Łre Ober┬Łfl├ż┬Łche und sei┬Łne m├żch┬Łti┬Łgen Werk┬Łzeu┬Łge las┬Łsen Sie Ihre Krea┬Łti┬Łvi┬Łt├żt ent┬Łfal┬Łten und Ihre Pro┬Łduk┬Łti┬Łvi┬Łt├żt stei┬Łgern. Libre┬ŁOf┬Łfice ver┬Łeint meh┬Łre┬Łre Anwen┬Łdun┬Łgen, was es zum ├╝ber┬Łzeu┬Łgends┬Łten frei┬Łen und quell┬Łof┬Łfe┬Łnen Office-Paket auf dem Markt macht: Wri┬Łter, die Text┬Łver┬Łar┬Łbei┬Łtung, Calc die Tabel┬Łlen┬Łkal┬Łku┬Łla┬Łti┬Łon, Impress, das Pr├ż┬Łsen┬Łta┬Łti┬Łons┬Łpro┬Łgramm, Draw das Zei┬Łchen┬Łpro┬Łgramm, Base die Daten┬Łbank┬Łver┬Łwal┬Łtung und Math der For┬Łme┬Łl┬Łedi┬Łtor. (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

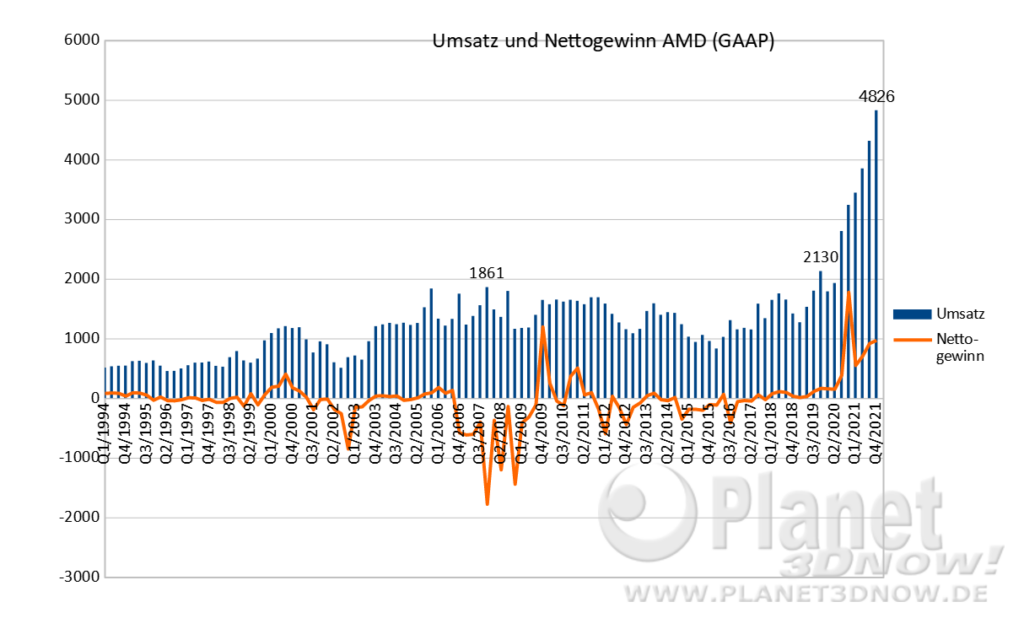

AMD Quartalszahlen Q4/2021: Fast 5 Milliarden Umsatz

Im vier┬Łten Quar┬Łtal 2021 hat AMD einen Umsatz von 4,826 Mil┬Łli┬Łar┬Łden US-Dol┬Łlar erzielt und dabei einen Net┬Łto┬Łge┬Łwinn von 974 Mil┬Łlio┬Łnen US-Dol┬Łlar erwirt┬Łschaf┬Łtet. Der Gewinn pro Aktie lag bei 0,80 US-Dol┬Łlar (Alle Zah┬Łlen nach GAAP). Erwar┬Łtet hat┬Łte AMD einen Umsatz von 4,5 Mil┬Łli┬Łar┬Łden US-Dol┬Łlar (+/- 100 Millionen).

Gegen┬Ł├╝ber dem Vor┬Łjah┬Łres┬Łquar┬Łtal stieg der Umsatz um 49 Pro┬Łzent, im Ver┬Łgleich zum vor┬Łher┬Łge┬Łhen┬Łden Quar┬Łtal betrug der Anstieg 12 Pro┬Łzent. Die Brut┬Łto┬Łmar┬Łge lag bei 50 Pro┬Łzent. Im gesam┬Łten Jahr 2021 hat AMD einen Umsatz┬Łzu┬Łwachs von 68 Pro┬Łzent erzielt, nach┬Łdem man Anfang 2021 noch von einem Zuwachs von ŌĆ£ledig┬ŁlichŌĆØ 50 Pro┬Łzent aus┬Łging. (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

AMD Reports Fourth Quarter and Full Year 2021 Financial Results

ŌĆĢ Record quar┬Łter┬Łly reve┬Łnue of $4.8B up 49% y/y; Record full year reve┬Łnue of $16.4B up 68%;

Gross mar┬Łgin expan┬Łded and ope┬Łra┬Łting inco┬Łme more than dou┬Łbled from pri┬Łor year ŌĆĢ

SANTA CLARA, Calif., Feb. 01, 2022 (GLOBE NEWSWIRE) ŌĆö AMD (NASDAQ:AMD) today announ┬Łced reve┬Łnue for the fourth quar┬Łter of 2021 of $4.8 bil┬Łli┬Łon, ope┬Łra┬Łting inco┬Łme of $1.2 bil┬Łli┬Łon, net inco┬Łme of $974 mil┬Łli┬Łon and diluted ear┬Łnings per share of $0.80. On a non-GAAP(*) basis, ope┬Łra┬Łting inco┬Łme was $1.3 bil┬Łli┬Łon, net inco┬Łme was $1.1 bil┬Łli┬Łon and diluted ear┬Łnings per share was $0.92.

For full year 2021, the com┬Łpa┬Łny repor┬Łted reve┬Łnue of $16.4 bil┬Łli┬Łon, ope┬Łra┬Łting inco┬Łme of $3.6 bil┬Łli┬Łon, net inco┬Łme of $3.2 bil┬Łli┬Łon and diluted ear┬Łnings per share of $2.57. On a non-GAAP(*) basis, ope┬Łra┬Łting inco┬Łme was $4.1 bil┬Łli┬Łon, net inco┬Łme was $3.4 bil┬Łli┬Łon and diluted ear┬Łnings per share was $2.79.

GAAP Quar┬Łter┬Łly Finan┬Łcial Results

(ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

Übernahme von Xilinx durch AMD vor Vollzug

Bereits in der letz┬Łten Woche hat mit der chi┬Łne┬Łsi┬Łschen Sta┬Łte Admi┬Łnis┬Łtra┬Łti┬Łon for Mar┬Łket Regu┬Łla┬Łti┬Łon (SAMR) die letz┬Łte Regu┬Łlie┬Łrungs┬Łbe┬Łh├Čr┬Łde unter Auf┬Łla┬Łgen der ├£ber┬Łnah┬Łme von Xilinx durch AMD zuge┬Łstimmt. Nun ste┬Łhen dem Voll┬Łzug nur noch tech┬Łni┬Łsche Regu┬Łla┬Łri┬Łen ent┬Łge┬Łgen, so dass die ├£ber┬Łnah┬Łme aller Vor┬Łaus┬Łsicht nach sp├ż┬Łtes┬Łtens nach Ablauf des 9. Febru┬Łars geneh┬Łmigt wird. (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

AMD Ryzen 9 5900 im B2-Stepping aufgetaucht

AMD h├Čchst selbst hat┬Łte das neue B2-Step┬Łping des Zen 3 bereits im Mai 2021 ange┬Łk├╝n┬Łdigt. Eini┬Łge Mona┬Łte sp├ż┬Łter waren BIOS-Sup┬Łport-Lis┬Łten bei diver┬Łsen Main┬Łboard-Her┬Łstel┬Łlern auf┬Łge┬Łtaucht, die neue Model┬Łle wie den Ryzen 7 5800 (ohne X) mit B2-Step┬Łping f├╝hr┬Łten und best├ż┬Łtig┬Łten, dass das neue Step┬Łping kei┬Łne neue BIOS-Ver┬Łsi┬Łon vor┬Łaus┬Łsetzt. Auch sie┬Łben Mona┬Łte nach der Ank├╝n┬Łdi┬Łgung hat┬Łte bis┬Łher aber nie┬Łmand einen Ryzen mit B2-Step┬Łping in frei┬Łer Wild┬Łbahn gese┬Łhen. (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

Xilinx Reports Record Revenue of $1.01 Billion in Fiscal Third Quarter

- Record reve┬Łnue of $1,011 mil┬Łli┬Łon, repre┬Łsen┬Łting 8% sequen┬Łti┬Łal growth and 26% year-over-year growth, despi┬Łte ongo┬Łing indus┬Łtry-wide sup┬Łp┬Łly constraints

- Data Cen┬Łter Group (DCG) achie┬Łved record reve┬Łnue with sequen┬Łti┬Łal growth of 28% and 81% year-over-year, dri┬Łven by Com┬Łpu┬Łte and Net┬Łwor┬Łking strength

- Aero┬Łspace & Defen┬Łse, Indus┬Łtri┬Łal and Test, Mea┬Łsu┬Łre┬Łment & Emu┬Łla┬Łti┬Łon (AIT) reve┬Łnue was also a record, incre┬Łasing 21% sequen┬Łti┬Łal┬Łly and 28% year-over-year, dri┬Łven by record A&D reve┬Łnue and con┬Łtin┬Łued strength in ISM and TME end markets

- Auto┬Łmo┬Łti┬Łve, Broad┬Łcast and Con┬Łsu┬Łmer (ABC) reve┬Łnue in the quar┬Łter decreased 4% sequen┬Łti┬Łal┬Łly coming off a record Q2 and lar┬Łge┬Łly in-line with expec┬Łta┬Łti┬Łons; reve┬Łnue increased 28% year-over-year

- Wired and Wire┬Łless Group (WWG) reve┬Łnue decreased 18% sequen┬Łti┬Łal┬Łly and increased 1% year-over-year as sup┬Łp┬Łly cons┬Łtraints had a signi┬Łfi┬Łcant impact on busi┬Łness in the quarter

- Plat┬Łform trans┬Łfor┬Łma┬Łti┬Łon con┬Łti┬Łnues with total Adap┬Łti┬Łve SoC reve┬Łnue, which includes Zynq and Ver┬Łsal plat┬Łforms, up 5% sequen┬Łti┬Łal┬Łly and 30% year-over-year, and repre┬Łsen┬Łting 28% of total revenue

SAN JOSE, Calif.ŌĆō(BUSINESS WIRE)ŌĆōJan. 26, 2022ŌĆō Xilinx, Inc. (Nasdaq: XLNX), the lea┬Łder in adap┬Łti┬Łve com┬Łpu┬Łting, today announ┬Łced record reve┬Łnues of $1,011 mil┬Łli┬Łon for the fis┬Łcal third quar┬Łter, up 8% over the pre┬Łvious quarter.

GAAP net inco┬Łme for the fis┬Łcal third quar┬Łter was $300 mil┬Łli┬Łon, or $1.19 per diluted share. Non-GAAP net inco┬Łme for the quar┬Łter was $325 mil┬Łli┬Łon, or $1.29 per diluted share.

As per┬Łmit┬Łted by the terms of the Mer┬Łger Agree┬Łment bet┬Łween Xilinx and Advan┬Łced Micro Devices, Inc. (AMD), the Xilinx Board of Direc┬Łtors voted unani┬Łmously to decla┬Łre a cash divi┬Łdend of $0.37 per out┬Łstan┬Łding share of com┬Łmon stock paya┬Łble on Febru┬Łary 14, 2022 to all stock┬Łhol┬Łders of record at the clo┬Łse of busi┬Łness on Febru┬Łary 7, 2022. The divi┬Łdend is con┬Łdi┬Łtio┬Łned upon and will only be paya┬Łble if the mer┬Łger has not clo┬Łsed on or befo┬Łre the record date for such divi┬Łdend. (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

Intel Reports Fourth-Quarter and Full-Year 2021 Financial Results

Deli┬Łvers Record Quar┬Łter┬Łly and Full-Year Revenue

News Sum┬Łma┬Łry

Ō¢¬ Fourth-quar┬Łter GAAP reve┬Łnue was $20.5 bil┬Łli┬Łon, excee┬Łding Octo┬Łber gui┬Łdance by $1.3 bil┬Łli┬Łon and up 3 per┬Łcent year-over-year (YoY). Fourth-quar┬Łter non-GAAP reve┬Łnue was $19.5 bil┬Łli┬Łon, excee┬Łding Octo┬Łber gui┬Łdance by $1.2 bil┬Łli┬Łon. Full-year GAAP reve┬Łnue set an all-time Intel record of $79.0 bil┬Łli┬Łon, up 1 per┬Łcent YoY.

Ō¢¬ Deli┬Łver┬Łed GAAP fourth-quar┬Łter ear┬Łnings per share (EPS) of $1.13, excee┬Łding Octo┬Łber gui┬Łdance by 35 cents. Fourth-quar┬Łter non-GAAP EPS was $1.09, excee┬Łding Octo┬Łber gui┬Łdance by 19 cents.

Ō¢¬ In 2021, Intel gene┬Łra┬Łted $30.0 bil┬Łli┬Łon of cash from ope┬Łra┬Łti┬Łons and $11.3 bil┬Łli┬Łon of free cash flow (FCF).

Ō¢¬ Fore┬Łcas┬Łting first-quar┬Łter 2022 reve┬Łnue of appro┬Łxi┬Łm┬Łate┬Łly $18.3 bil┬Łli┬Łon; expec┬Łting first-quar┬Łter EPS of $0.70 (non-GAAP EPS of $0.80).

Ō¢¬ Announ┬Łces five per┬Łcent increase to quar┬Łter┬Łly cash dividend.

SANTA CLARA, Calif., Janu┬Łary 26, 2022 ŌĆö Intel Cor┬Łpo┬Łra┬Łti┬Łon today repor┬Łted fourth-quar┬Łter and full-year 2021 finan┬Łcial results. The com┬Łpa┬Łny also announ┬Łced that its board of direc┬Łtors appro┬Łved a cash divi┬Łdend increase of five per┬Łcent to $1.46 per share on an annu┬Łal basis. The board declared a quar┬Łter┬Łly divi┬Łdend of $0.365 per share on the companyŌĆÖs com┬Łmon stock, which will be paya┬Łble on March 1 to share┬Łhol┬Łders of record as of Febru┬Łary 7.

ŌĆ£Q4 repre┬Łsen┬Łted a gre┬Łat finish to a gre┬Łat year. We excee┬Łded top-line quar┬Łter┬Łly gui┬Łdance by over $1 bil┬Łli┬Łon and deli┬Łver┬Łed the best quar┬Łter┬Łly and full-year reve┬Łnue in the companyŌĆÖs histo┬Łry,ŌĆØ said Pat Gel┬Łsin┬Łger, Intel CEO. ŌĆ£Our disci┬Łpli┬Łned focus on exe┬Łcu┬Łti┬Łon across tech┬Łno┬Łlo┬Łgy deve┬Łlo┬Łp┬Łment, manu┬Łfac┬Łtu┬Łring, and our tra┬Łdi┬Łtio┬Łnal and emer┬Łging busi┬Łnesses is reflec┬Łted in our results. We remain com┬Łmit┬Łted to dri┬Łving long-term, sus┬Łtainable growth as we relent┬Łless┬Łly exe┬Łcu┬Łte our IDM 2.0 stra┬Łtegy.ŌĆØ (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

AMD Radeon Software Adrenalin 22.1.2

Die neu┬Łes┬Łte Ver┬Łsi┬Łon der Rade┬Łon Soft┬Łware Adre┬Łna┬Łlin ŌĆö also des Trei┬Łbers f├╝r AMD-Gra┬Łfik┬Łkar┬Łten ŌĆö ist f├╝r Win┬Łdows 10 und Win┬Łdows 11 erschie┬Łnen. Die Ver┬Łsi┬Łon 22.1.2 unter┬Łst├╝tzt das Spiel ŌĆ£Tom ClancyŌĆÖs Rain┬Łbow Six Extra┬Łc┬ŁtionŌĆØ sowie die neu┬Łen Desk┬Łtop┬Łgra┬Łfik┬Łchips AMD Rade┬Łon RX 6500 XT und Rade┬Łon RX 6400 (OEM only) und die mobi┬Łlen Gra┬Łfik┬Łchips AMD Rade┬Łon RX 6500M und Rade┬Łon RX 6300M.

Zus├żtz┬Łlich wur┬Łde noch ein Feh┬Łler im Spiel ŌĆ£Bor┬Łder┬Łlands 3ŌĆØ beseitigt.

Den Down┬Łload┬Łlink, sowie die kom┬Łplet┬Łten Release Notes fin┬Łdet Ihr in unse┬Łrem Downloadbereich:

F├╝r ├żlte┬Łre Gra┬Łfik┬Łkar┬Łten die nicht mehr unter┬Łst├╝tzt wer┬Łden und f├╝r den letz┬Łten Win┬Łdows-7-Trei┬Łber fin┬Łdet ihr hier die Ver┬Łsi┬Łon 21.5.1:

(ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

Samsung Introduces Game Changing Exynos 2200 Processor With Xclipse GPU Powered By AMD RDNA 2 Architecture

The new pre┬Łmi┬Łum mobi┬Łle pro┬Łces┬Łsor comes with hard┬Łware-acce┬Łle┬Łra┬Łted ray tra┬Łcing and sta┬Łte of the art Arm-based pro┬Łces┬Łsing technology

Sam┬Łsung Elec┬Łtro┬Łnics, a world lea┬Łder in advan┬Łced semi┬Łcon┬Łduc┬Łtor tech┬Łno┬Łlo┬Łgy, today announ┬Łced its new pre┬Łmi┬Łum mobi┬Łle pro┬Łces┬Łsor, the Exy┬Łnos 2200. The Exy┬Łnos 2200 is a fresh┬Łly desi┬Łgned mobi┬Łle pro┬Łces┬Łsor with a powerful AMD RDNA 2 archi┬Łtec┬Łtu┬Łre based Sam┬Łsung Xclip┬Łse gra┬Łphics pro┬Łces┬Łsing unit (GPU). With the most cut┬Łting-edge Arm┬«-based CPU cores available in the mar┬Łket today and an upgraded neu┬Łral pro┬Łces┬Łsing unit (NPU), the Exy┬Łnos 2200 will enable the ulti┬Łma┬Łte mobi┬Łle pho┬Łne gam┬Łing expe┬Łri┬Łence, as well as enhan┬Łcing the over┬Łall expe┬Łri┬Łence in social media apps and photography.

ŌĆ£Built on the most advan┬Łced 4ŌĆænanometer (nm) EUV (extre┬Łme ultra┬Łvio┬Łlet litho┬Łgra┬Łphy) pro┬Łcess, and com┬Łbi┬Łned with cut┬Łting-edge mobi┬Łle, GPU and NPU tech┬Łno┬Łlo┬Łgy, Sam┬Łsung has craf┬Łted the Exy┬Łnos 2200 to pro┬Łvi┬Łde the finest expe┬Łri┬Łence for smart┬Łphone users. With the Xclip┬Łse, our new mobi┬Łle GPU built with RDNA 2 gra┬Łphics tech┬Łno┬Łlo┬Łgy from the indus┬Łtry lea┬Łder AMD, the Exy┬Łnos 2200 will rede┬Łfi┬Łne mobi┬Łle gam┬Łing expe┬Łri┬Łence, aided by enhan┬Łced gra┬Łphics and AI per┬Łfor┬Łmance,ŌĆØ said Yon┬Łgin Park, Pre┬Łsi┬Łdent of Sys┬Łtem LSI Busi┬Łness at Sam┬Łsung Elec┬Łtro┬Łnics. ŌĆ£As well as brin┬Łging the best mobi┬Łle expe┬Łri┬Łence to the users, Sam┬Łsung will con┬Łti┬Łnue its efforts to lead the jour┬Łney in logic chip inno┬Łva┬Łti┬Łon.ŌĆØ (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

LibreOffice 7.2.5 (Community)

Libre┬ŁOf┬Łfice ist ein kos┬Łten┬Łlo┬Łses, leis┬Łtungs┬Łstar┬Łkes Office-Paket, und ein Nach┬Łfol┬Łger von OpenOffice(.org). Sei┬Łne kla┬Łre Ober┬Łfl├ż┬Łche und sei┬Łne m├żch┬Łti┬Łgen Werk┬Łzeu┬Łge las┬Łsen Sie Ihre Krea┬Łti┬Łvi┬Łt├żt ent┬Łfal┬Łten und Ihre Pro┬Łduk┬Łti┬Łvi┬Łt├żt stei┬Łgern. Libre┬ŁOf┬Łfice ver┬Łeint meh┬Łre┬Łre Anwen┬Łdun┬Łgen, was es zum ├╝ber┬Łzeu┬Łgends┬Łten frei┬Łen und quell┬Łof┬Łfe┬Łnen Office-Paket auf dem Markt macht: Wri┬Łter, die Text┬Łver┬Łar┬Łbei┬Łtung, Calc die Tabel┬Łlen┬Łkal┬Łku┬Łla┬Łti┬Łon, Impress, das Pr├ż┬Łsen┬Łta┬Łti┬Łons┬Łpro┬Łgramm, Draw das Zei┬Łchen┬Łpro┬Łgramm, Base die Daten┬Łbank┬Łver┬Łwal┬Łtung und Math der For┬Łme┬Łl┬Łedi┬Łtor. (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗

TSMC Reports Fourth Quarter EPS of NT$6.41

Hsin┬Łchu, Tai┬Łwan, R.O.C., Janu┬Łary 13, 2022 ŌĆö TSMC today announ┬Łced con┬Łso┬Łli┬Łda┬Łted reve┬Łnue of

NT$438.19 bil┬Łli┬Łon, net inco┬Łme of NT$166.23 bil┬Łli┬Łon, and diluted ear┬Łnings per share of NT$6.41

(US$1.15 per ADR unit) for the fourth quar┬Łter ended Decem┬Łber 31, 2021.

Year-over-year, fourth quar┬Łter reve┬Łnue increased 21.2% while net inco┬Łme and diluted EPS both

increased 16.4%. Com┬Łpared to third quar┬Łter 2021, fourth quar┬Łter results repre┬Łsen┬Łted a 5.7%

increase in reve┬Łnue and a 6.4% increase in net inco┬Łme. All figu┬Łres were pre┬Łpared in accordance

with TIFRS on a con┬Łso┬Łli┬Łda┬Łted basis.

In US dol┬Łlars, fourth quar┬Łter reve┬Łnue was $15.74 bil┬Łli┬Łon, which increased 24.1% year-over-year and

increased 5.8% from the pre┬Łvious quar┬Łter. (ŌĆ”) Wei┬Łter┬Łle┬Łsen ┬╗